michigan use tax exemptions

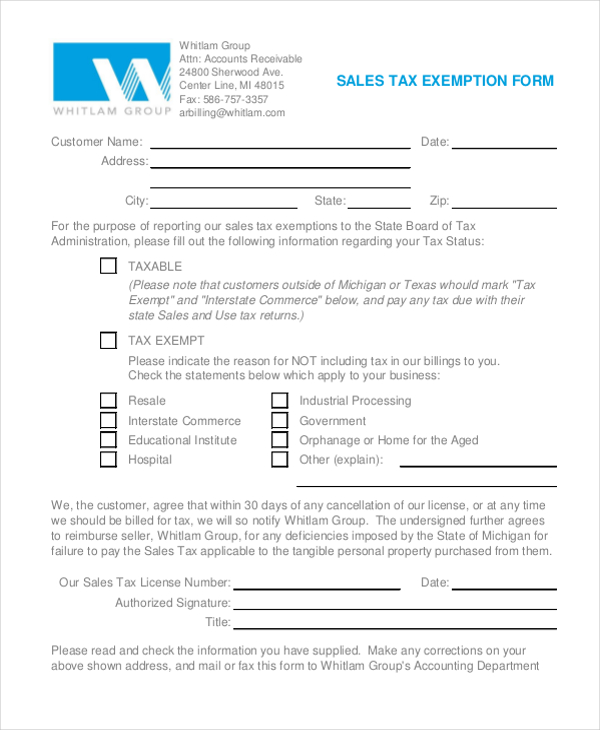

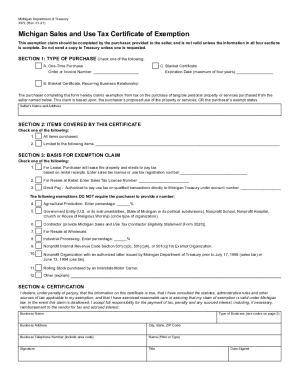

The certificate that qualifying agricultural producers organizations and other exempt entities may use is the Michigan Sales and Use Tax Certificate of Exemption or form. And farmers should not use your social security number as proof for a sales tax exempt purchase.

How To Register For A Sales Tax Permit In Michigan Taxvalet

Use tax is a companion tax to sales tax.

. Use Tax Exemption on Vehicle Title Transfers. 01-21 Michigan Sales and Use Tax Certificate of Exemption. The People of the State of Michigan enact.

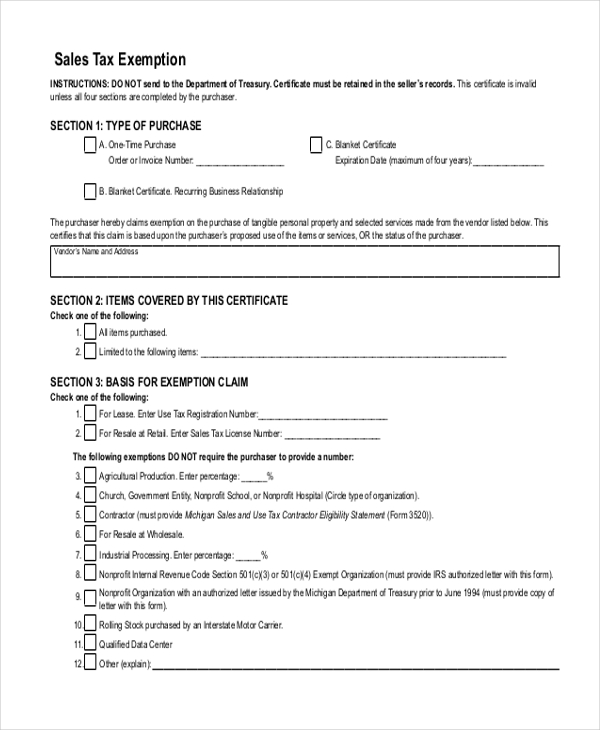

Michigan Sales and Use Tax Contractor. 2022 Michigan state use tax. This exemption claim should be completed by the purchaser provided to the seller.

Michigan Department of Treasury 3372 Rev. States that provide exemptions can be. When delivery is outside Michigan states may grant an exemption from sales and use tax on purchases made by the University of Michigan.

Michigan is uncommon in having only one Tax exemption. Printable Michigan Sales and Use Tax Certificate of Exemption Form 3372 for making sales tax free purchases in Michigan. Here in Michigan if you purchase tangible personal property for use in Michigan you have to either pay sales tax to the seller or pay whats called a use tax to the state.

Use tax of 6 must be paid to the State of Michigan on the total price including shipping and handling charges of all taxable items brought into. Transmittal for Magnetic Media Reporting of W-2s W-2Gs and 1099s to the State of Michigan. What is Exempt From Sales Tax in Michigan.

First there is no such thing as a sales tax exemption number for agriculture. While the Michigan sales tax of 6 applies to most transactions there are certain items that may be exempt from taxation. Streamlined Sales and Use Tax Project.

The MI use tax only applies to certain purchases. 1 This Revenue Administrative Bulletin RAB updates the general procedures. For transactions occurring on or after October.

The state of Michigan levies a 6 state sales tax on the retail sale lease or rental of most goods and some. Notice of New Sales Tax Requirements for Out-of-State Sellers. Michigan Sales Tax Exemptions.

This page discusses various sales tax exemptions in Michigan. The Michigan use tax is a special excise tax assessed on property purchased for use in Michigan in. 20591 Use tax act.

SALES AND USE TAX EXEMPTION CLAIM PROCEDURES AND FORMATS. Michigans use tax rate is six percent. The Michigan Sales and Use Tax Exemption Certificate can be used to purchase any of the tax exempt items in Michigan.

History1937 Act 94 Eff. This act may be cited as the Use Tax Act. For transactions occurring on and after October 1 2015 an out-of-state seller may be.

Retailers Retailers purchasing for resale should provide a signed exemption certificate by completing form 3372 Michigan Sales and Use Tax Certificate of Exemption and. This tax will be remitted to the state on monthly quarterly or annual returns as required by the Department. Instructions for completing Michigan Sales and Use Tax Certicate of Exemption Form 3372 Purchasers may use this form to claim exemption from Michigan sales and use tax on qualied.

The sales tax and use tax statutes operate differently but are intended to supplement and complement each other to collect on the overall 6 tax liability.

Free 8 Sample Tax Exemption Forms In Pdf Ms Word

Free 10 Sample Tax Exemption Forms In Pdf Ms Word

Michigan Vehicle Sales Tax Fees Calculator Find The Best Car Price

Fillable Online Utoledo 08t2 Michigan Sales And Use Tax Certificate Of Exemption Do Not Send To The Department Of Treasury Utoledo Fax Email Print Pdffiller

Michigan Sales And Use Tax Exemption For Ppe Uhy

Kpmg Us Tax On Twitter In Michigan The Court Of Appeals Addressed Whether Sales Of Container Recycling Machines And Repair Parts Qualified For A Sales And Use Tax Exemption For Industrial Processing Kpmgtax

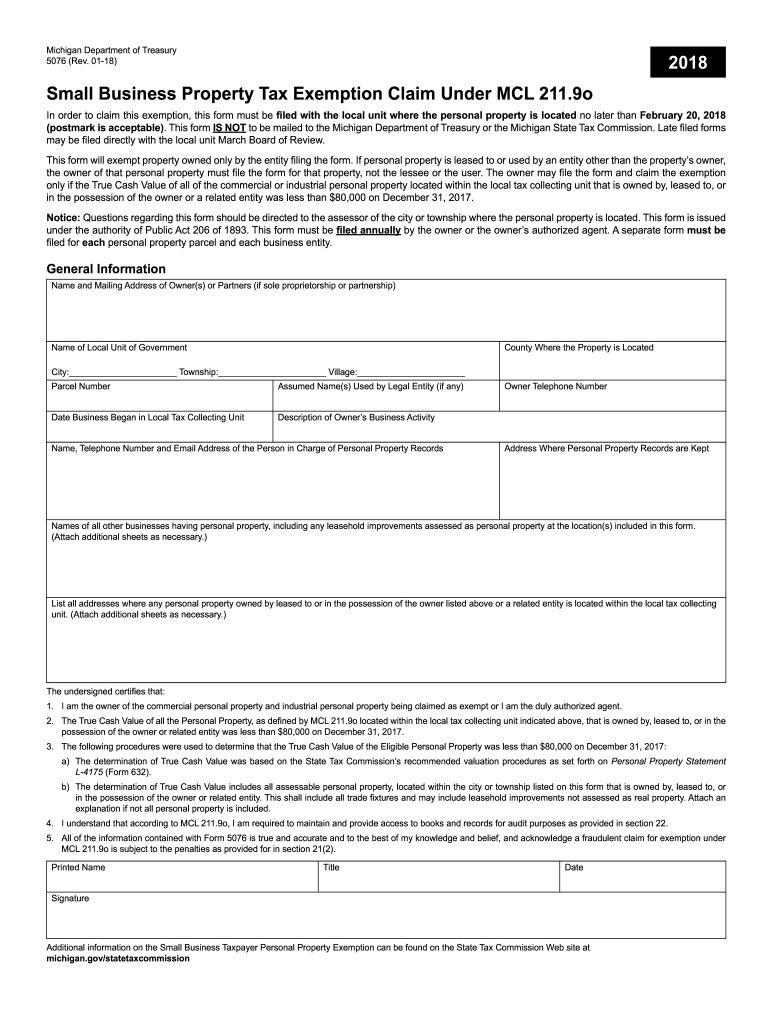

Small Business Property Tax Exemption Claim Under Mcl 211 Fill Out Sign Online Dochub

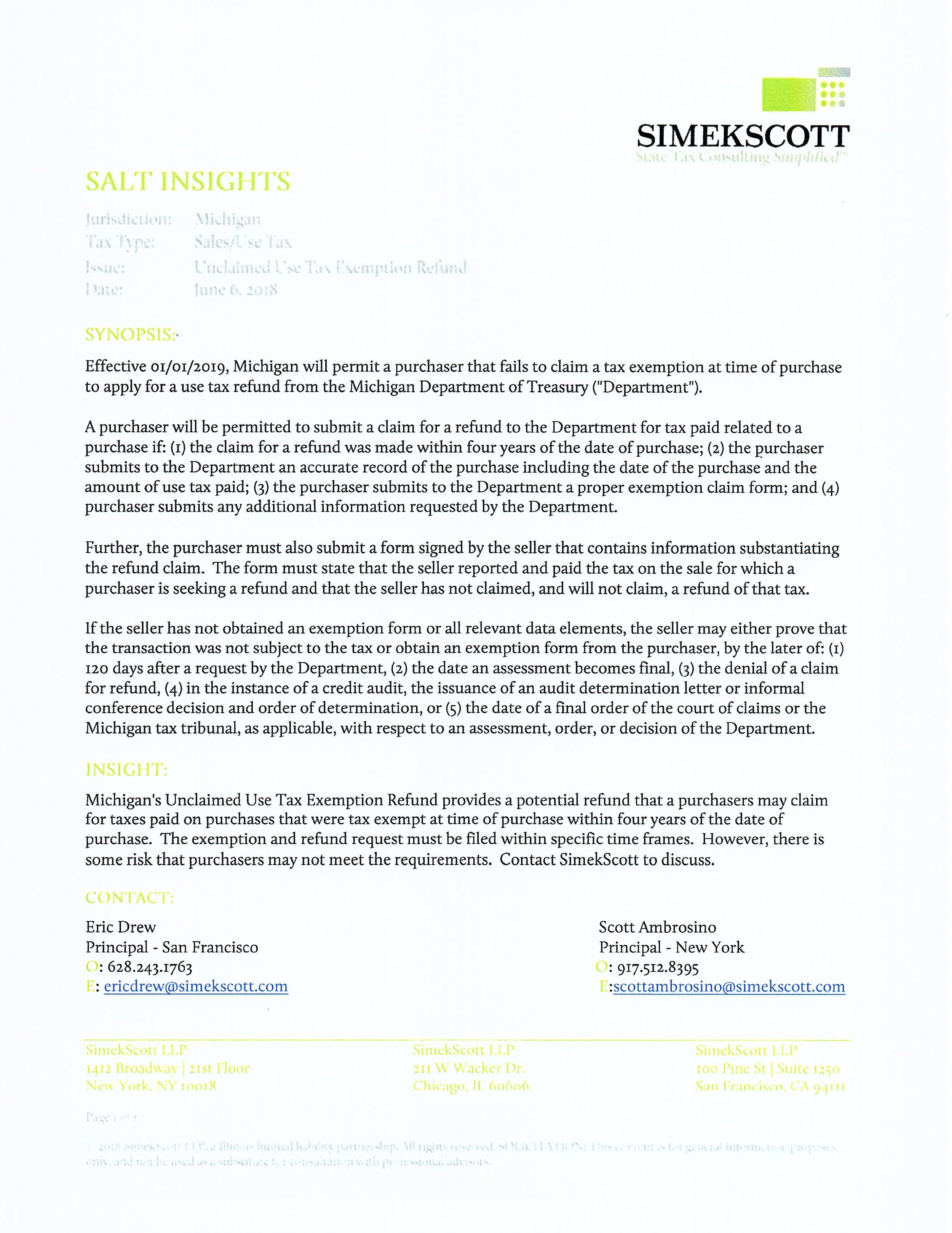

Michigan Unclaimed Use Tax Exemption Refund Simekscott

Michigan Unclaimed Use Tax Exemption Refund Simekscott

Resale Certificate The Get Out Of Tax Free Card For Eligible Enterprises

Michigan Certificate Of Tax Exemption From 3372 Fill Out Sign Online Dochub

Be Aware Of Recent Personal Property Tax Exemption Changes In Michigan Shindelrock

Michigan Sales Tax Guide And Calculator 2022 Taxjar

Form 3372 Michigan Sales And Use Tax Certificate Of 2021 2022